massachusetts restaurant alcohol tax

Charlie Baker signed a bill on July 20 allowing bars and restaurants in the state to sell to-go cocktails with takeout and delivery food orders. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content.

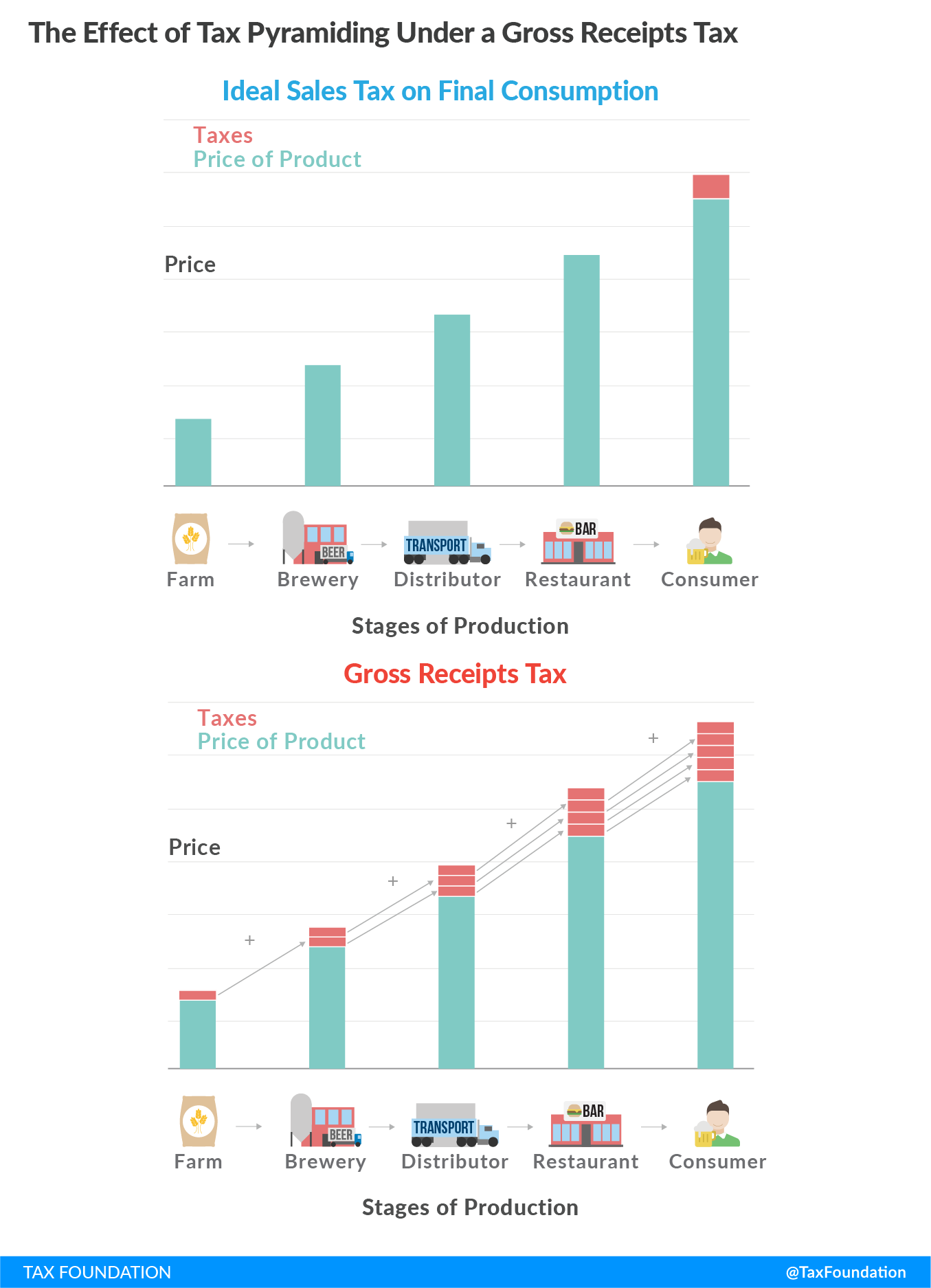

How Do State And Local Sales Taxes Work Tax Policy Center

Youths want to know the ages needed for serving alcohol in restaurants.

. Federal excise tax rates on beer wine and liquor are as follows. Some area restaurant owners say legislation supported by 20 state senators and representatives that would eliminate the states 625 percent meals tax on food and alcohol for a week in March would give local restaurants much-needed attention reports the Worcester Telegram. Whether you are facing an audit or want to safeguard your restaurant operations we have the experience to assist you.

Multiple snowstorms have kept people stuck inside and the proposed meals tax holiday March 20. A Massachusetts drivers license Massachusetts liquor ID passport or military ID are required for alcohol. For selling alcohol to drink off-site.

To schedule an initial consultation with an experienced tax lawyer call 866-485-7019 or complete our online contact form. Massachusetts local sales tax on meals. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

7 Operating under the influence penalties can vary depending on prior OUI offenses. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Massachusetts maximum blood alcohol level is 008 and 002 if the driver is under 21 years of age.

Restaurants In Matthews Nc That Deliver. This includes fraternal organizations. The allowance will last until Baker lifts Massachusetts state of emergency which was enacted on March 10 2020 in response to the pandemic.

The tax is 625 of the sales price of the meal. In 2011 that number was raised to 5 as of 2016 it was raised to 7 and in 2020 it will rise to 9. In MA transactions subject to sales tax are assessed at a rate of 625.

Generally any Chapter 180 corporation association or organization must pay a yearly excise tax of 57 on the gross receipts from the sale of alcoholic beverages. Charlie Bakers desk. A 625 state sales tax is applied to all alcoholic beverages sold at retail.

A bottle twice. Enzo Life Sciences Stock. Opry Mills Breakfast Restaurants.

A proposal to increase that tax to 625 percent is now in a. Massachusetts Restaurant Revitalization Fund Set-Asides. Generally food products people commonly think of as groceries are exempt from the sales tax except if they are sold as a meal from a restaurant.

Massachusetts alcohol laws are specific about this. A 750 ML bottle of wine includes an 11-cent excise tax. Its not exactly stop-the-presses stuff but it turns out that for the first two months of collections the imposition of the sales tax on beer wine and alcohol in Massachusetts has exceeded projections by about 33 percent.

Gross receipts from the sale of alcoholic beverages are the total proceeds from the sales of all drinks which. Massachusetts Restaurant Alcohol Tax. The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax.

East Peoria Restaurants Breakfast. Each bottle of beer sold in a package store is assessed 1-cent in excise tax so the cost of a 6-pack includes a 6-cent excise tax while the cost of a case 24 cans or bottles includes a 24-cent excise tax. Driving under the influence of alcohol in Massachusetts is a crime that is punishable by a fine andor imprisonment.

Your communications with us are also confidential protected by the attorney-client privilege. As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys tax of 125 Chicago the total tax Chicago-based restaurants face is 925. 1350 per proof-gallon or 214 per 750ml 80-proof bottle.

Before August 1 2009 the tax rate was 5. 100 of consumer products. Restaurants In Erie County Lawsuit.

If you are a Massachusetts business owner. Chicago Restaurant Tax. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol.

A special sales tax on alcoholic beverages was repealed in 2010. The safety net for Massachusetts residents struggling with. Hospitality has many often handling alcohol.

The tax took effect August 1 but revenue from sales tax is not reported until the 20th of the month. The legal drinking age in Massachusetts is 21. 700 sales tax 107.

Deval Patrick tried repeatedly without success to tax soda and voters in 2010 rejected higher taxes on alcohol but supporters of. Meals are also assessed at 625 but watch out. Find out more about the citys taxes on Chicagos government tax list.

Chapter 180 organizations. Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7. Massachusetts Department of Revenue.

5 billion is set aside for applicants with 2019 gross receipts of not more than 500000. A 625 state sales tax is applied to all items except non-restaurant food and clothing under 175. So for example as of now up to 7 Stop and Shops could sell beer wine and.

The bill allows customers to order. Restaurant owners noted that it was just six years ago that the state allowed Boston and other cities and towns to add a 075 percent local option tax on meals which includes an added tax on. Here is a quick consumer guide to the state alcohol excise tax.

Kay Khan a Newton Democrat is. Young people often want part-time jobs. Alcohol and sugary drinks in Massachusetts could carry a heavier price tag if two proposed bills are passed.

Bill to allow alcohol takeout delivery at Massachusetts restaurants on Gov. An additional 4 billion is set aside for applicants with 2019 gross receipts from 500001 to 1500000. Some tax discounts are available to small brewers.

Massachusetts Restaurant Alcohol Tax. But voters repealed that new sales tax on alcohol 52 percent to. In Massachusetts liquor vendors are responsible for paying a state excise tax of 405 per gallon plus Federal excise taxes for all liquor sold.

Previously an entity such as a grocery store chain in MA could hold up to 3 liquor licenses. 625 of the sales price of the meal.

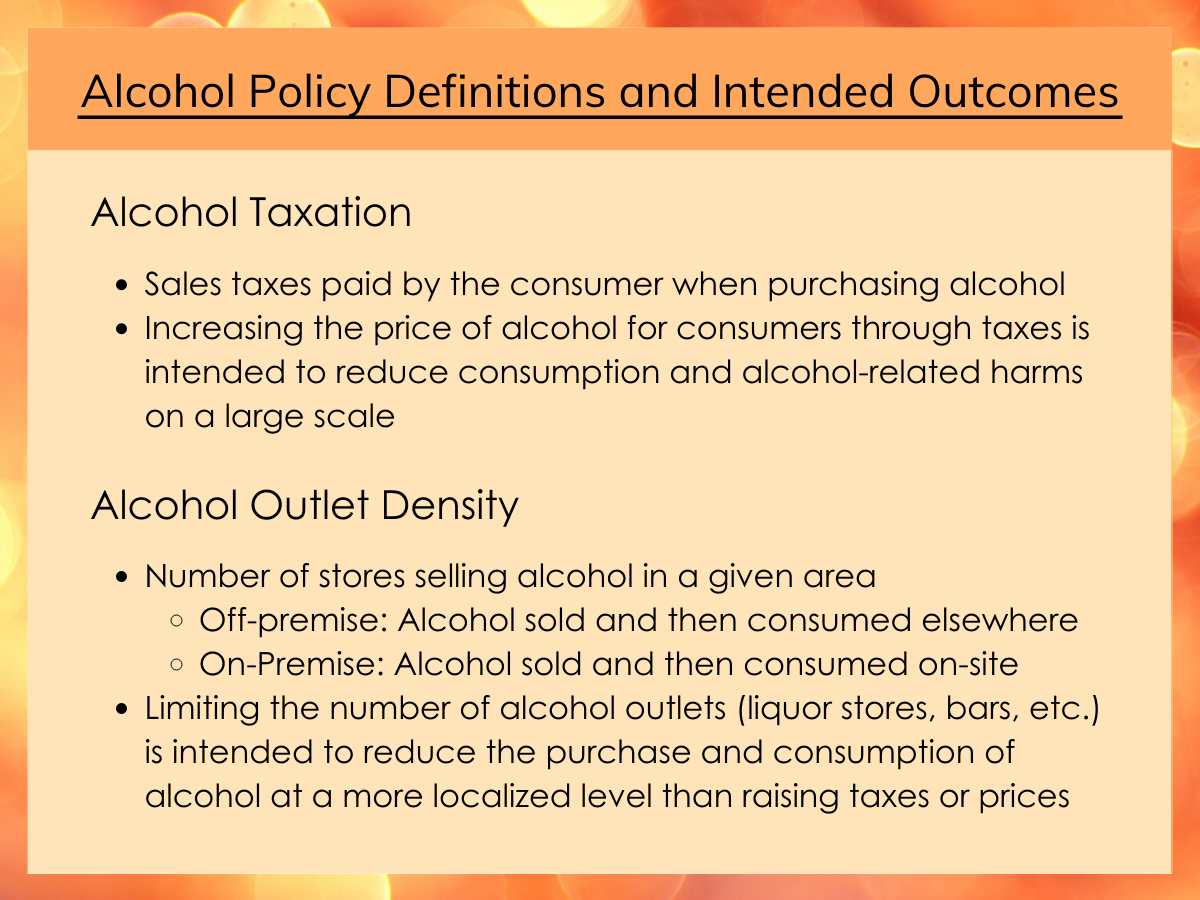

Price And Availability Revisited Do Alcohol Taxation And Sale Restrictions Also Reduce Harms For Marginalized Groups

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

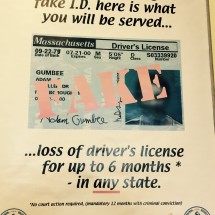

The Dangers Of Serving Alcohol To Customers With Out Of State I D S

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

How To Get A Liquor License Plus Other Restaurant Licenses You Need Lightspeed

How To Get A Liquor License In 2022 Restaurant Clicks

State Guide For Acquiring Liquor Licenses Pourmybeer

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Massachusetts Sales Tax Small Business Guide Truic

How To Sell Alcohol Online Delivery Laws In All 50 States 2ndkitchen

Massachusetts Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Alcohol Excise Taxes Current Law And Economic Analysis Everycrsreport Com

In Massachusetts Strict Drinking Laws Are Decades In The Making The Huntington News

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Diagram Drafting For Alcoholic Beverage License Applications

Best Selling Alcohol Brands 2020

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild